A UK-Based Group Allowed To Operate ASA Microfinance Bank In Pakistan: SBP

ISLAMABAD ( Web News )

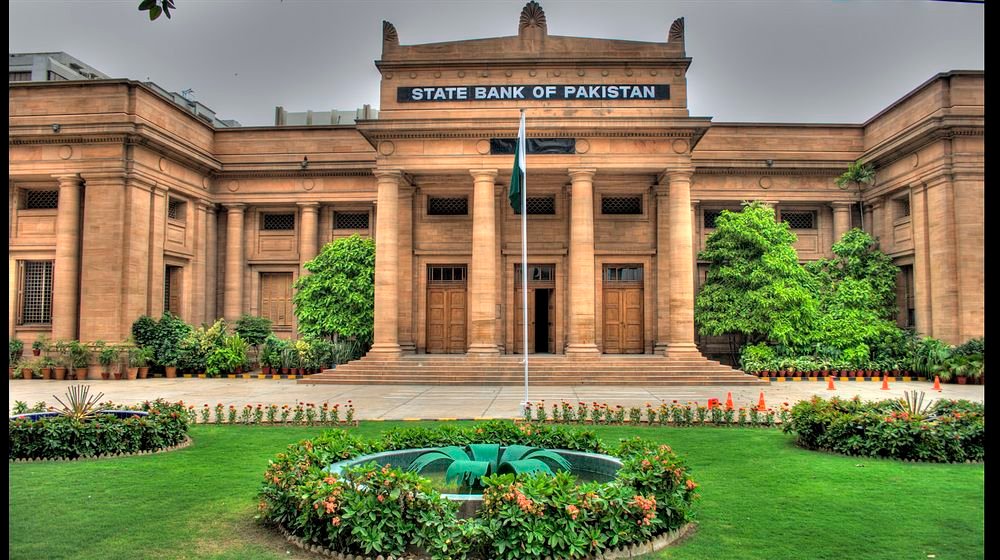

The State Bank of Pakistan allowed a UK-based group, ASA International Group to operate a new microfinance bank in Pakistan.

The State Bank of Pakistan (SBP) has allowed “ASA Microfinance Bank” (Pakistan) Limited to commence microfinance lending business nationwide from November 13, 2023.

ASA Microfinance Bank (Pakistan) Limited, licensed by SBP under the Microfinance Institutions Ordinance 2001, is a wholly owned subsidiary of ASA International Group plc. which is recognized as one of the world’s largest international microfinance institutions. The SBP announced this on Tuesday evening.

By commencing business, the new microfinance ban will be the 12th Microfinance Bank (MFB) to operate in the country.

MFBs play an important role in serving a large number of microcredit borrowers and depositors. MFBs have approximately three percent share of total advances of the banking system, however; in terms of the number of domestic borrowers, MFBs have a share of 58.6 percent, signifying their importance in Pakistan’s credit market, financial inclusion, and economy.

The commencement of business by ASA Microfinance Bank (Pakistan) Limited is expected to increase the market share of MFBs regulated by SBP within the overall microfinance sector.

Given the focus on women across their international network, the new bank is expected to play an important role in gender mainstreaming and female empowerment by providing small, socially responsible loans to low-income women entrepreneurs belonging to less-privileged and unbanked segments of the society.

It is expected that ASA Microfinance Bank (Pakistan) Limited will contribute towards poverty alleviation and financial inclusion mandate under the Microfinance Institution Ordinance, 2001.