Prime Minister Directs Focus on Public Convenience in Tax Reforms

Helpline to Assist with Filing Returns, Digital Invoicing to Be Launched in Urdu, PM’s Instructions in Meeting

Islamabad ( Web News )

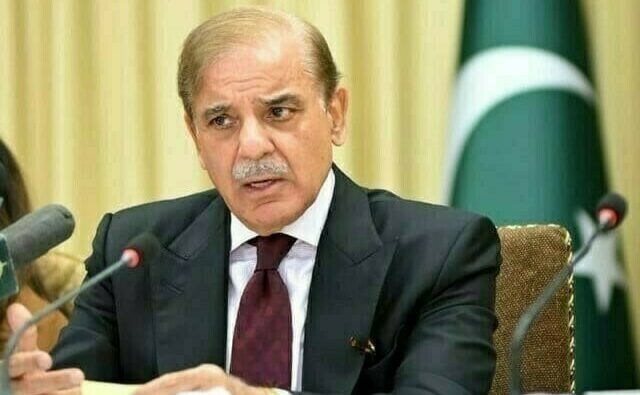

Prime Minister Shehbaz Sharif has issued instructions to prioritize public convenience in tax reforms. He welcomed the simplification and Urdu translation of tax return forms and directed that a helpline be established to assist with filing. Additionally, he ordered the launch of digital invoicing in Urdu.

Chairing the weekly review meeting on digitization of the Federal Board of Revenue (FBR), implementation of artificial intelligence (AI)-based systems, and other reforms, the Prime Minister emphasized that third-party validation should be ensured for transparency in all FBR reforms. He said tax returns have now been made digital, simplified, and linked to a centralized database for the public’s ease, adding that salaried individuals will benefit the most from the new simplified tax return system.

He instructed a public awareness campaign to educate people about the ease of filing tax returns, encouraging more citizens to file under the new system. The Prime Minister praised the Finance Minister, the economic team, FBR Chairman, and their staff for the positive outcomes of the reforms, attributing them to their hard work.

He stressed that expanding the tax base and reducing the tax burden on the poor are among the government’s top priorities. He noted that, for the first time in the country’s history, an AI-based tax assessment system has been implemented—a major success—and appreciated FBR’s efforts.

The Prime Minister further directed that special facilitation be provided to small and medium enterprises (SMEs) for inclusion in the digital invoicing system.

Participants in the meeting included Federal Ministers Ahsan Iqbal Cheema, Attaullah Tarar, Ali Pervaiz Malik, Minister of State for Finance Bilal Azhar Kayani, Chief Coordinator Mosharraf Zaidi, FBR Chairman Rashid Mahmood Langrial, and other senior officials.

The meeting was briefed on progress regarding digital invoicing, e-bilty, simplification of tax returns, AI-based assessment systems, the establishment of a central command and control center, and the cargo tracking system.

Regarding the FBR’s command and control unit, the meeting was informed that bidding will be completed soon, and the unit will be fully operational by September. This will not only ensure access to centralized data but will also facilitate decision-making.

A briefing was also given on the AI-based assessment system. It was shared that traders are now allowed to submit advance goods declarations prior to the arrival of ships, enabling complete exemptions on upfront duties and taxes. With the implementation of this system, the percentage of advance goods declarations is expected to rise from 3% to over 95%, allowing containers with advance declarations to be directly transported from ships to factories.

It was further shared that through digital invoicing, all small and large businesses will issue receipts through FBR’s online system at the time of purchase and sale. Around 20,000 businesses are expected to be integrated into the system within a few months. In just one month, 8,000 invoices worth Rs. 11.6 billion have been issued under this system.

The system includes a taxpayer portal and a monitoring dashboard. The system, provided under PRAL (Pakistan Revenue Automation Ltd), is free of charge and includes training for traders. Once fully implemented, traders will no longer need to file sales tax returns, as every transaction will be automatically recorded in the system.

Additionally, the adoption of an internationally compatible 8-digit HS code system will eliminate fake and flying invoices. Digital invoicing will also make it easier to assess the performance of the sales tax system.

The meeting was also updated on the progress of the cargo tracking and e-bilty systems. It was reported that the real-time monitoring of goods movement and corresponding tax payments is now synchronized, and AI-based assessments will enhance tax enforcement.

To ensure implementation in line with international standards, support is being sought from Türkiye. After a discussion between the Prime Minister and the President of Türkiye during his recent visit to Azerbaijan, a Turkish delegation has arrived in Pakistan to assist in the swift development and launch of the system.