KARACHI ( Web News )

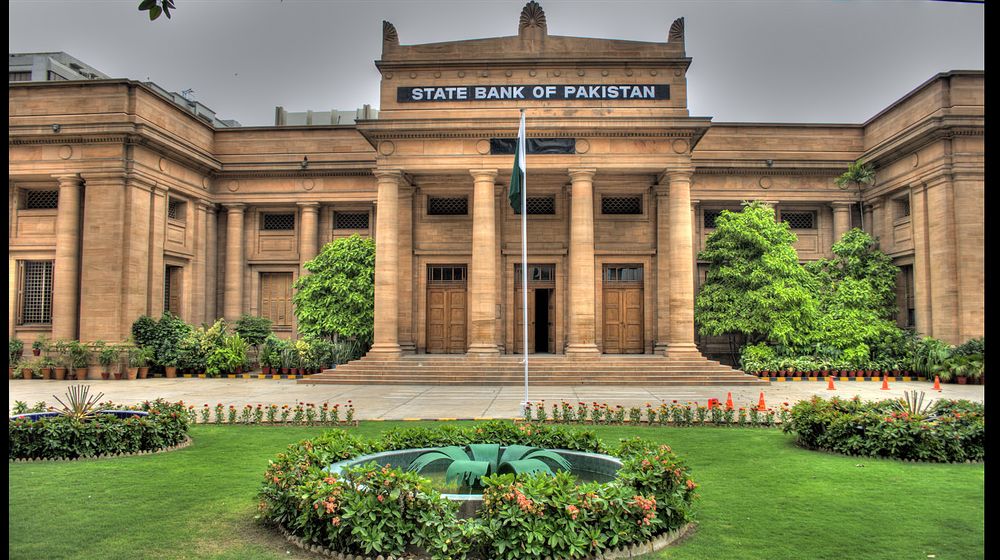

Pakistan’s central bank has imposed a penalty of slightly over Rs290 million on six commercial and Shariah-compliant banks for violating banking regulations related to foreign exchange, asset quality and general operation in the quarter ended September 30, 2022. All six are well-known banks including the two that are ranked among the top five. A tier-2 bank was fined Rs140 million for violating regulations including foreign exchange rules, the State Bank of Pakistan (SBP) said in its one-page report titled “Details of Significant Enforcement Actions by SBP During the Quarter ended September 30, 2022”.

The central bank imposed the monetary penalty on commercial banks included: Bank Al Habib Limited; Meezan Bank Limited; National Bank of Pakistan; MCB Bank Limited; JS Bank Limited; and Faysal Bank Limited.

The highest amount of penalty of Rs140.03 million has been imposed on Bank Al Habib Limited for violating regulatory instructions pertaining to CDD/KYC, Asset Quality, Foreign Exchange and general banking operations.

The SBP directed Bank Al Habib Limited that besides payment of monetary penalty it should strengthen its control/process in the identified areas.

The second highest penalty of Rs81.72 million has been imposed on Meezan Bank Limited for the same regulatory violations. The SBP also imposed penalties, included: Rs25.875 million on National Bank of Pakistan; Rs19.223 million on MCB Bank Limited; Rs13.49 million on JS Bank Limited; and Rs10.025 million on Faysal Bank Limited.

Recently, the central bank had initiated a probe into the conduct of eight banks, including the leading ones, for violating foreign exchange market regulations. The investigation began following allegations that the banks had manipulated the rupee value against the US dollar to pocket high profit margins. Although the SBP did not name the eight banks, it gave names of at least two banks in its latest report on the enforcement action for violating foreign exchange regulations. The second bank which violated the foreign exchange regulations is a well-known Shariah-compliant financial institution. It was charged the second highest amount of around Rs82 million.

The two banks also violated the regulations dealing with customer due diligence, Know Your Client (KYC), asset quality and general banking operation. “In addition to the penal action, the banks have been advised to strengthen their controls/ processes in the identified areas,” the central bank said. “These actions (monetary penalty) are based on deficiencies in the compliance of regulatory instructions and do not constitute a comment on the financial soundness of the entities,” it said. Four other banks were charged fines in the range of Rs10 million to Rs26 million for violating regulations pertaining to customer due diligence/ KYC, asset quality and general banking operation.