ISLAMABAD (PRESS RELEASE)

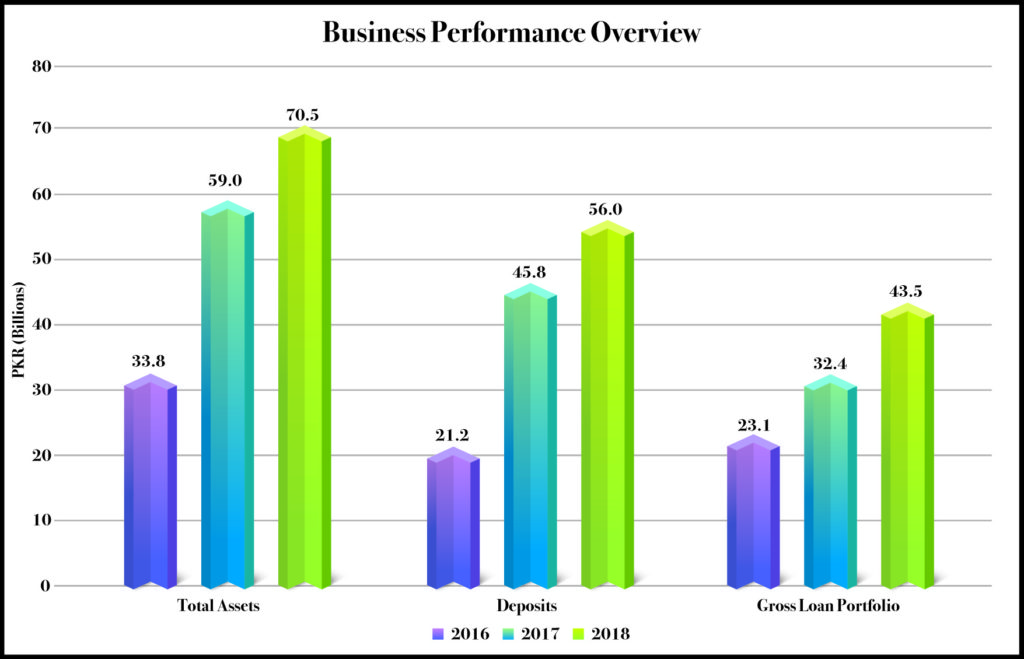

Khushhali Microfinance Bank Limited (KMBL) posted its financial results for the year ended December 31, 2018 in Islamabad. With a marked improvement in performance, KMBL maintained its upward growth momentum in year 2018. The bank announced a pre-tax profit of PKR 3.5 billion, one of the highest reported profits in the industry, and up by 40% against last year’s pre-tax profit of PKR 2.5 billion. This rise can be attributed to growth in balance sheet supported by continued increase in KMBL’s lending portfolio which went up by 34% from last year. Portfolio quality indicators remain stable and the bank is well capitalized with a capital adequacy ratio of 18.9%.

Building on its strong performance over the past five years, the Bank has not only maintained but elevated its position in the microfinance sector. KMBL is actively expanding into new urban and rural markets effectively targeting its potential client segment and with 197 locations the Bank has one of the largest networks across the country. It enjoys a market leadership position with the highest number of clients, loan portfolio, deposits, asset base and profitability amongst the microfinance banks. Agriculture sector remains the mainstay of lending portfolio of KMBL owing to the opportunities available within the largely unbanked segments of the market. The deposit book of over PKR 56 billion also appreciated by 22% in comparison to 2017, and the Bank proposed a dividend of PKR 1.50 per share.

In order to sustain and capitalize on growth opportunities in the market, the Bank raised its capital through successful injection of Tier II capital of PKR 1 billion. The bank continues to invest in technology up gradation to enhance its capability to offer Digital Financial services to its customers.

Founded in the year 2000, Khushhali Microfinance Bank has come a long way to fulfill its objectives of providing affordable financial services to the poor. In acknowledgement of its outstanding performance, KMBL received the “Best Microfinance Bank” award at the third Pakistan Banking Awards 2018. The bank is owned by a consortium of investors including one of Pakistan’s largest commercial banks (UBL), and Blue Chip international investors with expertise in the Micro, Small & Medium Enterprise finance.